Table of Content

The borrower makes payments to the lender over a set period of time until the loan is paid in full. Our affordability calculator uses the current national average mortgage rate. Your interest rate will vary based on factors like credit score and down payment. To calculate your repayments you need to know what the principal is (the amount you’re borrowing), what the interest rate is and loan term is.

For example, if you have one credit card with a $10,000 limit and another with a $3,000 limit, the lender will write down a $13,000 debt against you. Return on investment from a rental property is more commonly referred to as rental yield. Put simply rental yield is expressed as a percentage, measuring the difference between the income received from tenants and the overall costs of your investment.

House price slowdown slashes Aussie’s household wealth

The middle ground could just represent tolerable debt symbolized by 2. Investors often engage in the type 1 obligations since they are expectant of making profits. There are some standard calculations our credit team use to measure the financial impact each dependant can have - these numbers are factored into our home loan calculators. Ask your home loan specialist for more detail about how it's worked out. Employment status can have an influence on your borrowing power, as it might be more complex to demonstrate your income if you’re in this position, and don't always have a regular salary for example.

The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner's income and the typical local home value. Lenders have a pre-qualification process that takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. This is the total amount of money earned for the year before taxes and other deductions.

How much can I borrow?

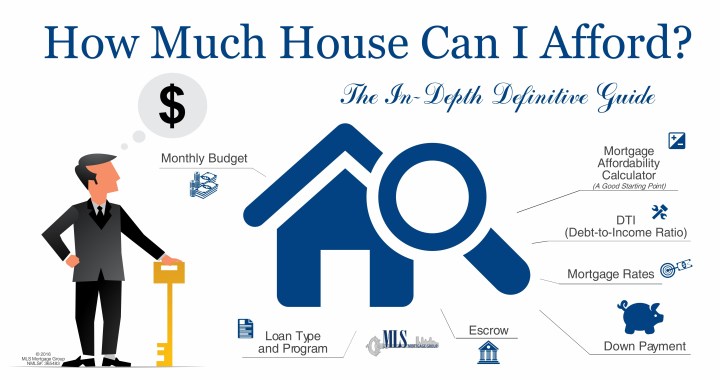

This is a separate calculator used to estimate house affordability based on monthly allocations of a fixed amount for housing costs. With a FHA loan, your debt-to-income limits are typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner's insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget. Other calculators, like the stamp duty calculator, may require you to enter your location, while our income tax calculator will require you to include your income and current expenses. This type of loan is also called honeymoon loan in Australia because the borrower is given a leniency period when they only repay loans at a discounted rate.

Aussies set aside bigger share of income for mortgage repayments

The question of whether you can afford to invest is probably the biggest determining factor of whether you can enter the property market. Unlike other forms of investing, you need quite a large sum just to get into the market, which we will discuss later. It sounds easy enough, but it’s important to understand that investing in property isn’t a guaranteed ticket to make money. As with any other investment, you should ensure you understand how to manage your portfolio effectively in order to reach your financial goals.

However, buying a home in the Australia is seen as a way of preserving living standards because living on the move tends to be expensive over time & Australia has went over 26 years without a recession. The lower the interest rate, the more you can borrow and the lower any minimum repayment amounts will be. When working out yourLVR, remember to base it on the bank’s valuation rather than the price you’re prepared to pay.

Save a bigger deposit

A lender is a financial institution that provides a loan directly to you. A conventional loan is a type of mortgage that is not insured or guaranteed by the government. If you cannot immediately afford the house you want, below are some steps that can be taken to increase house affordability, albeit with time and due diligence. A VA loan is a mortgage loan granted to veterans, service members on active duty, members of the national guard, reservists, or surviving spouses, and is guaranteed by the U.S. The calculator is not a guarantee and can provide an estimate only.

The younger generation is particularly in constant need for living spaces as they navigate the business world. As a current home owner, you may want to consider using equity you’ve built up, to help buy your next home or investment property. Equity is the difference between your property’s current market value, and what you still owe on your home loan.

All interest rates quoted are for new business only, expressed as a nominal Annual Percentage Rate and subject to change. Calculate your repayments & total interest under different fixed & variable rate scenarios with theSplit Loan Calculator. Use theHome Loan Calculatorto work out what your minimum weekly, fortnightly or monthly repayments would be on your home loan. All Applications are subject to credit assessment,eligibility criteria and lending limits. Information provided is factual information only, and is not intended to imply any recommendation about any financial product or constitute tax advice. Luckily, we've curated a collection of calculators to help you along the way.

The first-home grant owner is a famous model for motivating home ownership as where government contributes to a person's savings intended for purchasing a home. The government provides a percentage of yearly savings to lessen the length of the saving period. The strategy is effective in promoting savings among potential home owners seeking homes with values below $400,000. However, the national initiative has been dissolved and now applies according to the state of investment.

Realtor.com provides information and advertising services – learn more. If your down payment is less than 20 percent of your home's purchase price, you may need to pay for mortgage insurance. You can get private mortgage insurance if you have a conventional loan, not an FHA or USDA loan. Rates for PMI vary but are generally cheaper than FHA rates for borrowers with good credit.

No comments:

Post a Comment